venmo tax reporting limit

Those posts refer to a provision in the American Rescue Plan Act which went into effect on January 1 2022 according to which anyone receiving 600 per year using Venmo PayPal Zelle or Cash App will receive a 1099-K and be required to report that income on their taxes. While Venmo is required to send this form to qualifying users its worth.

The threshold was both 20000 and 200 transactions.

. If the funds being transferred are for goods or a service the new law simply requires businesses to report those funds exceeding 600 rather than the old 20000 limit. There are a wide variety of tax forms used for income reporting purposes. Dont Believe The Hype Bidens 600 Tax Plan Wont Force You to Report All Venmo Transactions to the IRS.

1 mobile money apps like Venmo PayPal and Cash App must report annual commercial transactions of 600 or more to the Internal Revenue Service. Venmo debit card limits Venmo offers a physical debit card powered by MasterCard which you can use to spend the money in your Venmo account. Darylann Elmi Getty ImagesiStockphoto.

Prior to this legislation third-party payment platforms would only report to the tax agency if a user had more than 200 commercial transactions and made more than 20000 in payments over the. So even if you made 50K but only had 30 transactions you wouldnt get a 1099-K. 1 mobile payment apps like Venmo PayPal and Cash App are required to report commercial transactions totaling more than 600 per year to the.

Residents of Illinois have a 1000 cap as long as there are more than three payments. It does not change what is taxable or deductibleit merely seeks to achieve more honest reporting for companies that do a large percentage of their business on Venmo. These tax forms are also known as information returns like W-2 1099s etc.

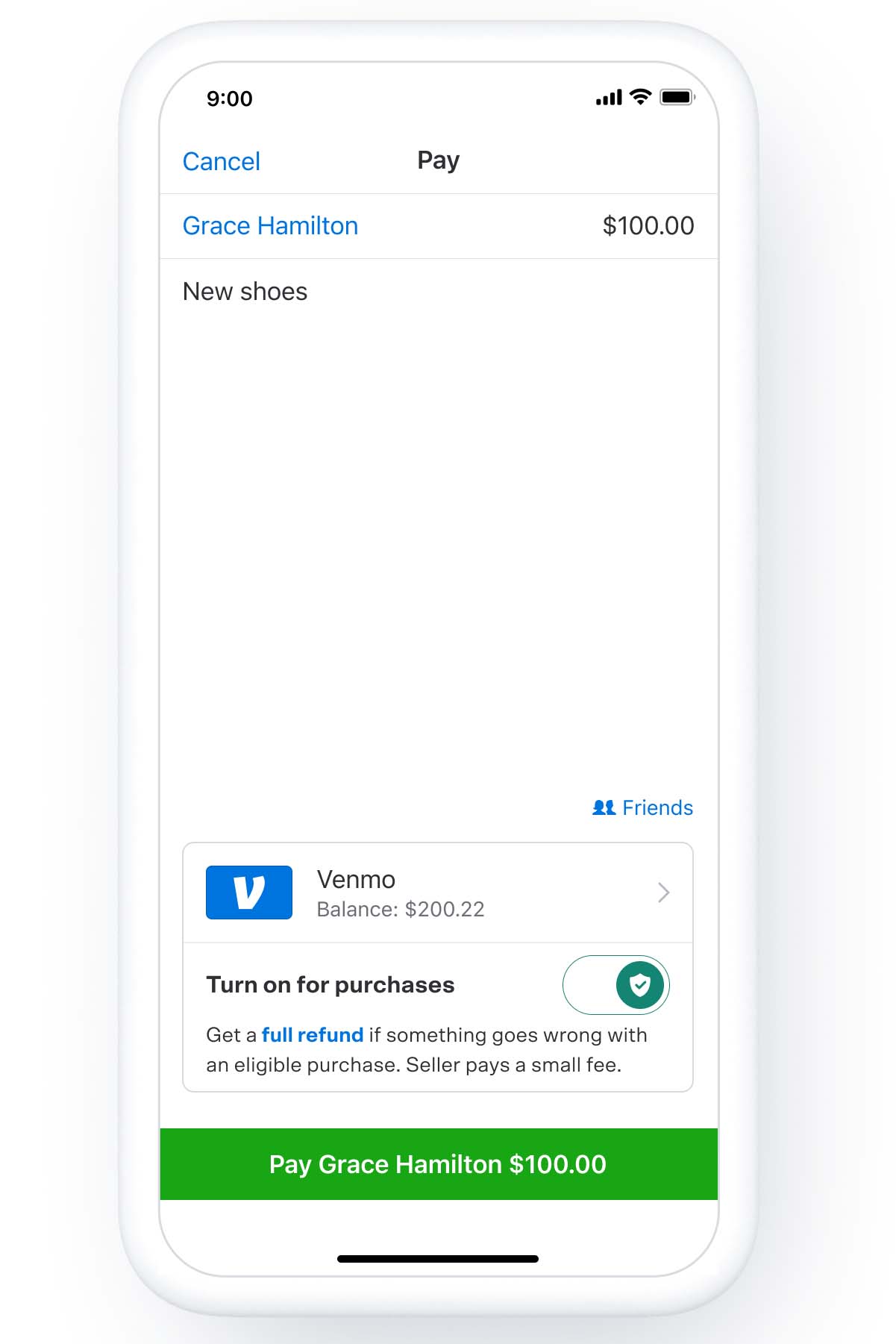

According to PayPal while banks and payment service providers like PayPal and Venmo are required by the IRS to send customers a Form-1099K if they meet the 600 threshold amount there are certain amounts that may be included on the form that are generally excluded from gross income and therefore are not subject to income tax. Anyone who receives at least 600 in payments for goods and services through Venmo or any other payment app can expect to receive a Form 1099-K. For most states the threshold is 20000 USD in gross payment volume from sales of goods or services in a single year AND 200 payments for goods and services in the same year.

January 19 2022 504 PM 2 min read. Payment app providers will have to start reporting to the IRS a users business transactions if in aggregate they total 600 or more for the year. For the 2021 tax year Venmo will issue a Form 1099-K to business profile owners who have passed the IRS reporting threshold for their state of residence.

Government passed legislation for 2022 as part of the American Rescue Plan Act that forces online payment platforms like Venmo PayPal Stripe and Square to report all aggregate business. The IRS is not requiring individuals to report or pay taxes on individual Venmo Cash App or PayPal transactions over 600. 1 2022 third-party payments apps like Venmo and PayPal were required to begin reporting goods and services payments of 600 or more to the Internal Revenue Service.

The new reporting requirement only applies to sellers of goods and services not. This reporting is also done with the persons and businesses that received the payments. There has been a flurry of furious cash app users this past week angrily responding to rumors of President Joe Bidens new tax reporting plan.

There has been a flurry of furious cash app users this past week angrily responding to rumors of President Joe Bidens new tax reporting plan requiring taxpayers to. The IRS still expects taxpayers to report any taxable income they get from a P2P payment platform if they meet these requirements even. There is one thing thats often overlooked.

Congress updated the rules in the American Rescue Plan Act of 2021. A business transaction is defined as payment. It impacts all payments apps including.

Venmo CashApp and other third-party apps to report payments of 600 or more to the IRS. Federal income tax. If you have verified your identity your combined weekly spending limit is 699999 and includes person-to-person payments in-apponline purchases and any purchases made with your Venmo debit card or QR codes.

Theres a weekly rolling limit of 1500 USD when it comes to transferring money to your Venmo balance³. Thats way bigger than the 600 threshold for most 1099s. If you havent verified your identity within Venmo yet your weekly spending limit is 29999.

1099-K Threshold and why it matters Originally there was a large threshold for businesses to receive these. When Venmo and taxes are involved. Starting the 2022 tax year the IRS will require reporting of payment transactions for goods and services sold that meets or exceeds 600 in a calendar year.

Beginning with tax year 2022 if someone receives payment for goods and services through a third- party payment network their income will be reported on Form 1099-K if 600 or more was processed as opposed to the current Form 1099-K reporting requirement of 200 transactions and 20000. The new rule was part of the American Rescue Plan passed by Democrats without a single GOP vote and signed by President Joe Biden in March 2021. 1 mobile money apps like Venmo PayPal and Cash App must report annual commercial transactions of 600 or more to the Internal Revenue Service.

The IRS is not requiring individuals to report or pay taxes on individual Venmo Cash App or PayPal transactions over 600.

Venmo Paypal And Zelle Must Report 600 In Transactions To Irs

Cryptocurrency And Taxes What You Need To Know In 2021 Cryptocurrency Debt Solutions Bitcoin

Clarifications And Complexities Of The New 1099 K Reporting Requirements Cpa Practice Advisor

What To Know About The Irs New Reporting Requirements For Venmo Paypal And Other Payment Apps

Here Are The Tax Changes Coming To Venmo Cash App Paypal And Other Apps Forbes Advisor

New Venmo Tax Law Are You Filing Correctly Behindthechair Com

Afraid The Irs Will Tax Your Venmo Paypal Or Other Payment App Transactions Here S What You Should Do The Washington Post

Tax Day Venmo And Paypal Users Face More Paperwork Under New Us Rules Us News The Guardian

How To Avoid Accidentally Paying Tax On Money Received Through Zelle Gobankingrates

Press Release How To Confirm Your Tax Information To Accept Goods Services Payments On Venmo In 2022

If You Use Venmo Paypal Or Other Payment Apps This Tax Change May Affect You In 2022

.jpeg)

New P2p Tax Laws Of 2022 In The Us Simplified Compareremit

New Tax Law Sell More Than 600 A Year Venmo Paypal Stripe And Square Must Report Your Income To The Irs Gobankingrates

Press Release How To Confirm Your Tax Information To Accept Goods Services Payments On Venmo In 2022

New Tax Rule Ensure Your Venmo Transactions Aren T Accidentally Taxed Gobankingrates

New Venmo Paypal Tax Reporting Rules What You Need To Know Hourly Inc

New Rule To Require Irs Tax On Cash App Business Transactions Wbma

If You Use Venmo Paypal Or Other Payment Apps This Tax Rule Change May Affect You Wral Com